In a surprising twist, a third IRS agent involved in the Hunter Biden case has stepped into the spotlight. In a closed-door interview held on Capitol Hill on September 12, Michael Batdorf testified that he felt “frustrated” at the roadblocks U.S. Attorney David Weiss encountered from the Department of Justice when pursuing charges against Joe Biden’s embattled son.

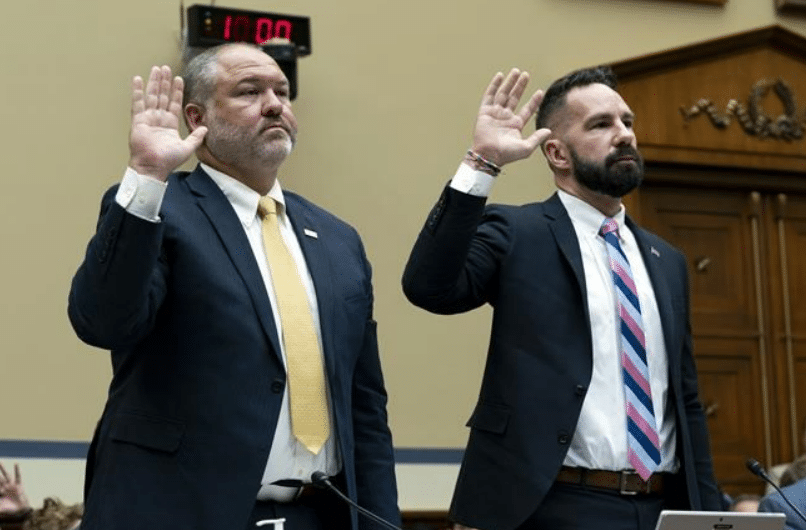

Batdorf’s statements align with the testimonies of Gary Shapley and Joseph Ziegler, the initial two whistleblowers who shared their concerns with Congress. Specifically, they assert that Attorney General Merrick Garland’s claim of granting Weiss unrestricted authority to pursue charges does not hold true. The IRS agent also expressed his own growing frustration with the Department of Justice’s obstructive behavior in impeding the investigation.

Furthermore, Batdorf disclosed a potentially new instance of corruption: Weiss’s decision to remove Gary Shapley from the case.

Additionally, Batdorf indicated that the Department of Justice appeared to be extending preferential treatment to Hunter Biden, affording his legal team significantly more opportunities to engage with the DOJ’s tax division than an average individual would receive. This afforded Hunter the chance to present his case in order to influence the investigation’s outcome.

From the Washington Examiner:

A third IRS official confirmed that Delaware U.S. Attorney David Weiss faced roadblocks when attempting to bring charges against Hunter Biden, contradicting denials issued Wednesday by Attorney General Merrick Garland.

IRS Director of Field Operations Michael Batdorf told the House Ways and Means Committee in a closed-door interview on Sept. 12 that he felt “frustrated” by the refusal of the Justice Department to approve tax charges that IRS agents viewed as well-supported by evidence, according to a transcript of the interview obtained by the Washington Examiner.

He also said the IRS removed agent Gary Shapley, a whistleblower, from the Hunter Biden case at the direction of Weiss despite having done nothing wrong.

Batdorf’s testimony was the latest piece of evidence to suggest Weiss did not enjoy the unfettered authority to pursue Hunter Biden that Garland and others claimed he had.

….

“DOJ Tax would have to authorize charges prior to David Weiss recommending an indictment or prosecution,” Batdorf said during his interview.

“So, I mean, my understanding is that, I mean, he can’t make that decision without DOJ Tax authorization,” Batdorf said.

The IRS supervisor confirmed that Hunter Biden’s defense team was given an unusual number of chances, possibly as many as four, to meet with DOJ Tax investigators and argue why its client should not face charges.

Tensions between DOJ Tax and the IRS investigators over the strength of the case began after DOJ Tax officials started meeting with Hunter Biden’s defense lawyers, Batdorf said.