The IRS will have nearly 87,000 new agents as a result of Joe Biden’s newly signed Inflation Reduction Act and will be creating a centralized office to manage their increasing wealth.

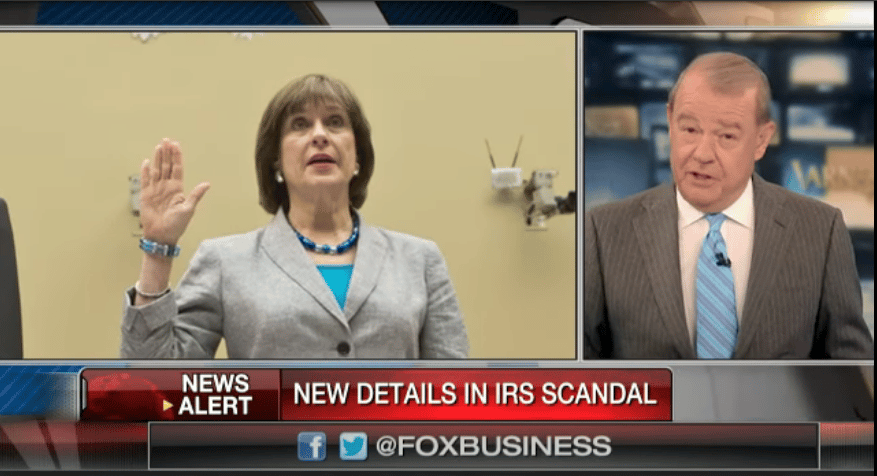

The Biden regime appointed Nicole Flax, who worked for Lois Lerner during the IRS’s crooked targeting of several conservative groups during the Obama admin, to head up that office.

As the Daily Caller exclusively reported, Lerner and her underling Nikole Flax, a frequent White House visitor, announced a new program scrutinizing tax-exempt applicants at a conference at Washington’s Grand Hyatt Hotel in February 2010. Lerner and Flax, whose computer crashes allegedly deleted both of their emails, looked at conservative donor information as part of a “secret research project” approved by then-IRS commissioner Steven T. Miller

The Gateway Pundit reported:

The IRS Conservative Targeting Scandal involved:

- Hundreds of conservative groups were targeted

- At least 5 pro-Israel groups

- Constitutional groups

- Groups that criticized Obama administration

- At least two pro-life groups

- An 83 year-old Nazi concentration camp survivor

- A 180 year-old Baptist paper

- A Texas voting-rights group

- A Hollywood conservative group was targeted and harassed

- Conservative activists and businesses

- At least one conservative Hispanic group

- IRS continued to target groups even after the scandal was exposed

- 10% of Tea Party donors were audited by the IRS

- And… 100% of the 501(c)(4) Groups Audited by IRS Were Conservative

Biden’s IRS is training troops to use deadly force against American citizens:

In an email message to all IRS employees, obtained by The Daily Signal, IRS Commissioner Charles Rettig wrote: “This is a historic time for the IRS, and we are working to move quickly to begin work on the Inflation Reduction Act signed into law earlier this week.”

Rettig wrote:

A key part of our efforts will be the creation of a new, centralized office for implementation of all IRS-related provisions. Building off our successes implementing other major legislative bills, the IRA 2022 Transformation & Implementation Office will work across the IRS and oversee our implementation efforts.

Rettig wrote:

A key part of our efforts will be the creation of a new, centralized office for implementation of all IRS-related provisions. Building off our successes implementing other major legislative bills, the IRA 2022 Transformation & Implementation Office will work across the IRS and oversee our implementation efforts.

It is estimated that 57.3 per cent of the 86,852 new IRS agents would be assigned to tax enforcement.

As reported by The Daily Signal, Biden and congressional Democrats assert that no one earning less than $400,000 a year will face new taxes, however, other analysts project that the package as passed will impose a $4,500 tax increase on the average American over the next decade.

Rettig said that the IRS would provide details about the new office, in the coming days:

Given the wide scope of the new legislation, the new office will be supported by five subsidiary offices that will be focused on specific areas: implementation of new tax law provisions, taxpayer services transformation, tax compliance transformation, human capital transformation, and communications and outreach efforts. The new office will work closely with the business units to implement the act, and with IT to align our modernization efforts.