Biden’s weaponized IRS attempted to harass and intimidate Twitter Files journalist Matt Taibbi.

An IRS agent showed up at the home of Twitter Files journalist, Matt Taibbi, on the same day he testified before Jim Jordan’s Committee on Weaponization of the Federal Government.

But since when do IRS agents pay house visits? The IRS doesn’t even make phone calls, let alone just show up unannounced. If the IRS needs to communicate, they send a letter, sometimes a certified letter.

On March 9, Matt Taibbi posted a new Twitter Files before his testimony to Congress: THE CENSORSHIP-INDUSTRIAL COMPLEX.

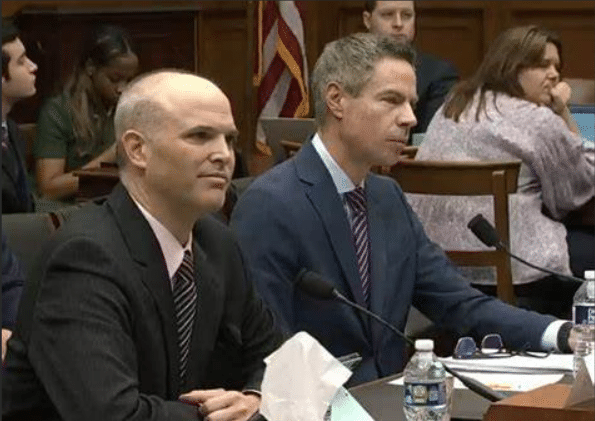

Taibbi and journalist Michael Shellenberger appeared before Congress later that same day.

The FTC had already been harassing Elon Musk and demanding he “identify all journalists” who had access to the Twitter files.

The weaponized IRS also showed up to Matt Taibbi’s home on March 9 in an effort to intimidate him.

Taibbi told Jim Jordan that an IRS agent showed up unannounced to his Jersey home and left a note for him to call the tax agency.

The Wall Street Journal reported:

Democrats are denouncing the House GOP investigation into the weaponization of government, but maybe that’s because Republicans are getting somewhere. That includes new evidence that the Internal Revenue Service may be targeting a journalist who testified before the weaponization committee.

House Judiciary Chairman Jim Jordan sent a letter Monday to IRS Commissioner Daniel Werfel and Treasury Secretary Janet Yellen seeking an explanation for why journalist Matt Taibbi received an unannounced home visit from an IRS agent. We’ve seen the letter, and both the circumstances and timing of the IRS focus on this journalist raise serious questions.

Now Mr. Taibbi has told Mr. Jordan’s committee that an IRS agent showed up at his personal residence in New Jersey on March 9. That happens to be the same day Mr. Taibbi testified before the Select Subcommittee on the Weaponization of the Federal Government about what he learned about Twitter. The taxman left a note instructing Mr. Taibbi to call the IRS four days later. Mr. Taibbi was told in a call with the agent that both his 2018 and 2021 tax returns had been rejected owing to concerns over identity theft.

Mr. Taibbi has provided the committee with documentation showing his 2018 return had been electronically accepted, and he says the IRS never notified him or his accountants of a problem after he filed that 2018 return more than four-and-a-half years ago.

He says the IRS initially rejected his 2021 return, which he later refiled, and it was rejected again—even though Mr. Taibbi says his accountants refiled it with an IRS-provided pin number. Mr. Taibbi notes that in neither case was the issue “monetary,” and that the IRS owes him a “considerable” sum.

The IRS has some explaining to do and should be brought before Congress and forced to answer for their actions that day.