President Trump reportedly suggested a bold proposal on Thursday to eliminate income tax and implement an “all tariff policy,” according to CNBC.

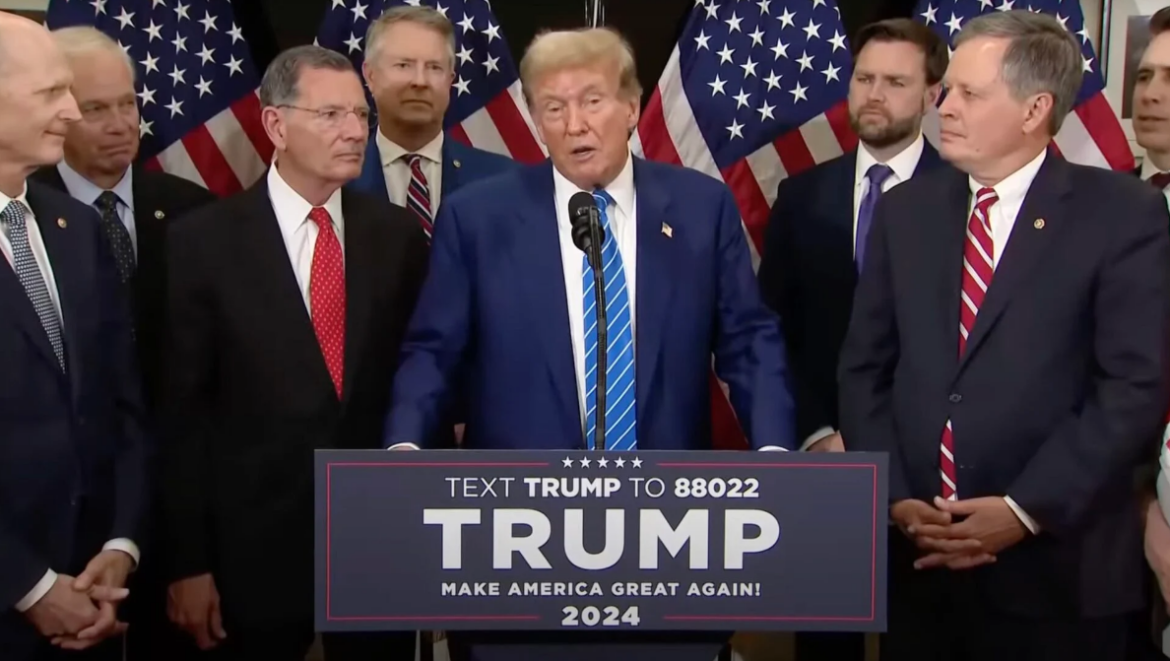

This significant proposal was made during a private meeting with Republican lawmakers at the Capitol Hill Club in Washington, D.C., as part of his plan to Make America Great Again.

CNBC reported that the meeting, held at a Business Roundtable event, included prominent business leaders such as Blackstone CEO Steve Schwarzman, JPMorgan Chase CEO Jamie Dimon, Carlyle Group CEO Harvey Schwartz, and AT&T CEO John Stankey, among others.

The news outlet, citing anonymous sources, reported that President Trump proposed abolishing income taxes in favor of an “all tariff policy.”

BREAKING: Trump allegedly floated the concept of eliminating the income tax and replacing it with tariffs at the GOP meeting at the Capitol Hill Club. pic.twitter.com/i8MEOcitQF

— Leading Report (@LeadingReport) June 13, 2024

In a Truth Social post, Trump wrote, “Great meeting with Republican Representatives. Lots discussed, all positive, great poll numbers!”

For 126 years, the United States had no Federal Income Tax. We have only had it for 122 years since its introduction in 1913.

The Founding Fathers never considered an income tax. At that time, wealth was equated with land. Taxes were based on property ownership, with additional revenue coming from tariffs and land sales. This system remained unchanged until the Civil War when Lincoln briefly introduced an income tax, which was temporary and targeted only the extremely wealthy. The modern income tax began under President Woodrow Wilson with the ratification of the 16th Amendment. Initially, this tax applied only to the top 1% and was set at a rate of 1%. It was during WWII that income tax was applied to everyone for the first time. Since then… well, you know how the story ends.

Here’s the timeline:

- 1776-1861: No federal income tax.

- 1861-1872: Federal income tax during the Civil War, repealed after the war.

- 1872-1913: No federal income tax.

- 1913-Present: Federal income tax established with the ratification of the 16th Amendment and the subsequent Revenue Act of 1913.

More from CNBC:

Donald Trump on Thursday brought up the idea of imposing an “all tariff policy” that would ultimately enable the U.S. to get rid of the income tax, sources in a private meeting with the Republican presidential candidate told CNBC.

Trump, in the meeting with GOP lawmakers at the Capitol Hill Club in Washington, D.C., also talked about using tariffs to leverage negotiating power over bad actors, according to another source in the room.

The remarks show Trump, who championed tariffs as a foreign policy multi-tool during his first term in office, is considering a drastically more protectionist trade agenda if he defeats President Joe Biden in November.

Spokespeople for Trump’s campaign did not immediately respond to CNBC’s requests for comment. Trump in a Truth Social post later Thursday morning said there was “lots discussed, all positive” in the meeting, without providing any more details.

Trump’s remark about replacing income taxes with tariffs quickly drew critics.

“Broadly substituting tariffs for income tax is a sure way to hit hard low and middle income Americans and reward top,” New York University School of Law professor David Kamin wrote on X.

Washington Post op-ed columnist Catherine Rampell noted that since tens of millions of Americans who pay no federal income taxes would presumably fall under Trump’s tariff plan, “this sounds like a huge tax increase on the lower/middle income classes.”

During a rally in Las Vegas on Sunday, President Trump revealed that, when elected president, he will eliminate all taxes on tips for restaurant workers, hospitality workers, and others who are earning tips.

In his speech, Trump emphasized economic relief for working-class Americans, particularly those in service industries who rely heavily on tips.

“This is the first time I’ve said this,” Trump announced, “and for those hotel workers and people that get tips, you’re going to be very happy. When I get back into office, we are going to eliminate taxes on tips. We’re going to do that right away, first thing in office.”