Whistleblowers from the IRS have alleged that the Department of Justice (DOJ) tipped Hunter Biden off before a search was conducted on his storage unit. The testimonies of two whistleblowers directly involved in Hunter Biden’s tax evasion case reveal a concerning pattern of misconduct and abuse of power within the IRS and FBI throughout the investigation.

These allegations include claims of unequal enforcement of tax laws, interference by the DOJ in the investigation, and retaliation against IRS personnel who exposed the misconduct.

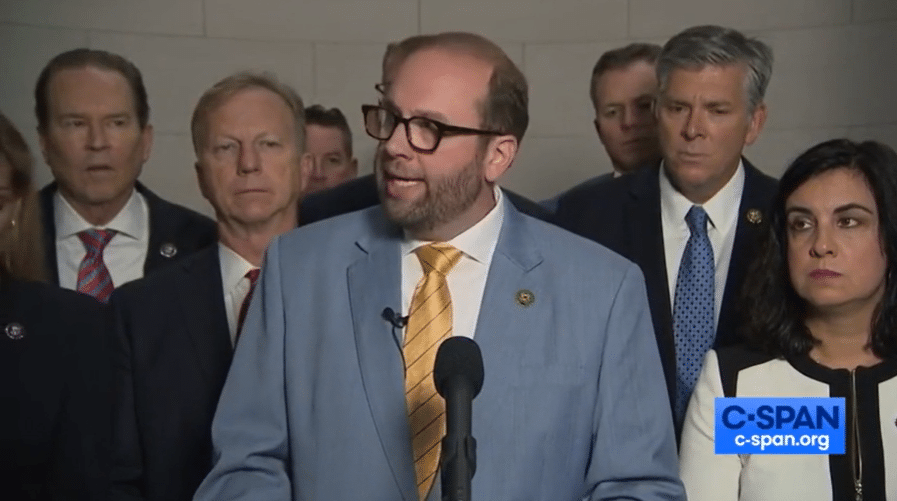

The Ways and Means Committee voted 25-18, along party lines, to authorize the release of transcripts containing IRS whistleblower testimony regarding the allegations. Chairman Jason Smith (R-MO) addressed the matter in a public statement following the closed-door hearing. It is noteworthy that all Democrat committee members voted against releasing the transcripts publicly.

During a press conference held after the hearing, Chairman Smith conveyed that the panel had been presented with whistleblower testimony highlighting instances of government misconduct, resulting in preferential treatment towards Hunter Biden. He emphasized that such preferential treatment is especially concerning to the American public, given the growing apprehension surrounding the potential misuse of government power against its citizens.

“Mr. Biden has been under investigation for tax crimes that include evading taxes on income from foreign sources,” Smith said.

“There are three areas of focus in the transcripts [and] interviews with whistleblowers,” he continued.

“Number one, the federal government is not treating taxpayers equally when enforcing tax laws.”

“Number two, whistleblowers claim the Biden Department of Justice is intervening and overstepping when it comes to the investigation of the president’s son.

“Number three, these whistleblowers report they have received almost immediate retaliation.”

“Let me emphasize: this was an investigation in the ordinary course of work at the IRS. It was not ordered by any individual, any chairman, or any political entity,” he said.

Despite IRS officials recommending charges related to tax evasion, fraud, false statements, and willful failures to file tax returns on an income exceeding $8.3 million, Biden received preferential treatment during the investigation. Chairman Smith alleges that the Justice Department employed a strategy of “Delay, Divulge, and Deny” to shield Hunter, ultimately allowing the statute of limitations on his tax offenses to expire.

Smith shared that the testimony provided by the whistleblowers, “details a lack of U.S. attorney independence, recurring unjustified delays, unusual actions outside the normal course of any investigation, a lack of transparency across the investigation and prosecution teams, and bullying and threats from the defense counsel.”

“This was a campaign of delay, divulge, and deny,” Smith said.

Watch:

Sean Davis and Greg Price detailed the whistleblowers’ claims:

You can read the redacted transcript from the first whistleblower here and the second one here.

The House Ways and Means Committee published the following report on Wednesday:

A Ways and Means Committee executive meeting resulted in a vote to release to the public whistleblower testimony of two different IRS employees who worked directly on the tax evasion case of Hunter Biden.

That testimony outlines misconduct and government abuse at the Internal Revenue Service (IRS) and the Federal Bureau of Investigation (FBI) in the investigation of Hunter Biden.

The allegations point to a steady campaign of:

unequal treatment of enforcing tax law; Department of Justice (DOJ) interference in the form of delays, divulgences, and denials, into the investigation of tax crimes that may have been committed by the President’s son; and finally, retaliation against IRS employees who blew the whistle on the misconduct.

Ways and Means Committee Chairman Jason Smith (MO-08) released the following statement:

“Today, the Ways and Means Committee voted to make public the testimony of IRS employees blowing the whistle on misconduct at the IRS and the Biden Department of Justice regarding unequal enforcement of tax law, interference and government abuse in the handling of investigations into criminal activity by President Biden’s son, Hunter Biden, and retaliation against IRS employees blowing the whistle on this abuse.

“The American people deserve to know that when it comes to criminal enforcement, they are not on the same playing field as the wealthy and politically connected class. The preferential treatment Hunter Biden received would never have been granted to ordinary Americans.

“Whistleblowers describe how the Biden Justice Department intervened and overstepped in a campaign to protect the son of Joe Biden by delaying, divulging, and denying an ongoing investigation into Hunter Biden’s alleged tax crimes.

The testimony shows tactics used by thhttps://wltreport.com/“The Committee has acted in good faith with participation from both Democrats and Republicans, as the issues raised today ought to be a bipartisan concern.

Hopefully we can find a path forward to continue to go where the facts lead us. If the federal government is not treating all taxpayers equally, or if it is changing the rules to engineer a preferred outcome, Congress has a duty to ask why and to hold agencies accountable and consider appropriate legislative action.

The scales of justice must not be skewed in favor of the wealthy and the politically connected.”

What the Committee Has Learned

The federal government is not treating all taxpayers the same – and providing preferential treatment to the wealthy and well-connected, including the son of the President of the United States.

Despite the fact that IRS officials recommended that Hunter Biden be charged with criminal activity that includes attempts to evade or defeat taxes, fraud and false statements, and willful failures to file returns, supply information, or pay taxes for over $8.3 million in income, Mr. Biden received preferential treatment in the course of the investigation, and has struck a plea deal that will likely keep him out from behind bars. Meanwhile…

In 2014, the U.S. Attorney for the Southern District of Florida announced that a man was sentenced to 13 months in prison to be followed by a year of supervised release for failing to file an income tax return, the same misdemeanor tax offense that Hunter Biden was charged with.

The Department of Justice interfered in the investigation into Hunter Biden’s clear tax issues with a “Delay, Divulge, and Deny” campaign – that ultimately shielded him by allowing the statute of limitations to pass on his tax crimes.

DELAY: Recurring unjustified delays pervaded the investigation, including in authenticating the message between Hunter Biden and Chinese officials. Investigators were told by U.S. Attorney Lesley Wolf that “there is no way” a search warrant for evidence would get approved because the evidence of interest would be found in the guest house of former Vice President Biden.

e Justice Department to delay the investigation long enough to reach the statute of limitations, evidence they divulged sensitive actions by the investigative team to Biden’s attorneys, and denied requests by the U.S. Attorney to bring charges against Biden.

“IRS employees who blew the whistle on this abuse were retaliated against, despite a commitment IRS Commissioner Werfel made before the Ways and Means Committee to uphold their legal protections. They were removed from this investigation after they responsibly worked through the chain of command to raise these concerns.

DIVULGE: Investigators found out that attorneys for Hunter Biden were tipped off about actions relating to the investigation in advance. For example, even as investigators had probable cause to search a Northern Virginia storage unit in which Hunter Biden had stored files, attorneys for Biden were tipped off.

DENY: U.S. Attorney of Delaware David Weiss tried to bring charges in District of Columbia around March 2022 and was denied. Weiss sought special counsel status from DOJ in the Spring of 2022 and was denied. Weiss sought to bring charges in the Central District of California in the Fall of 2022 and had that request denied in January 2023.

IRS employees worked through the chain of command to blow the whistle on this misconduct – only to be met with hostility and retaliation, leading them to come to the Ways and Means Committee.

Actions were taken to cut the IRS investigative team out of the process after they raised concerns up their chain of command. One whistleblower was not selected for a position, when he was more qualified than the candidate who was selected.

Limits and pauses have been placed on other, unrelated investigations that the whistleblowers are working on – which hamper the investigators’ ability to do their work or advance.

The whistleblowers and their entire team were removed from the investigation on May 15, 2023, after blowing the whistle to Congress.