The real wages of Americans fell for the 19th month in a row in October due to the inflation crisis that has originated under Joe Biden’s administration.

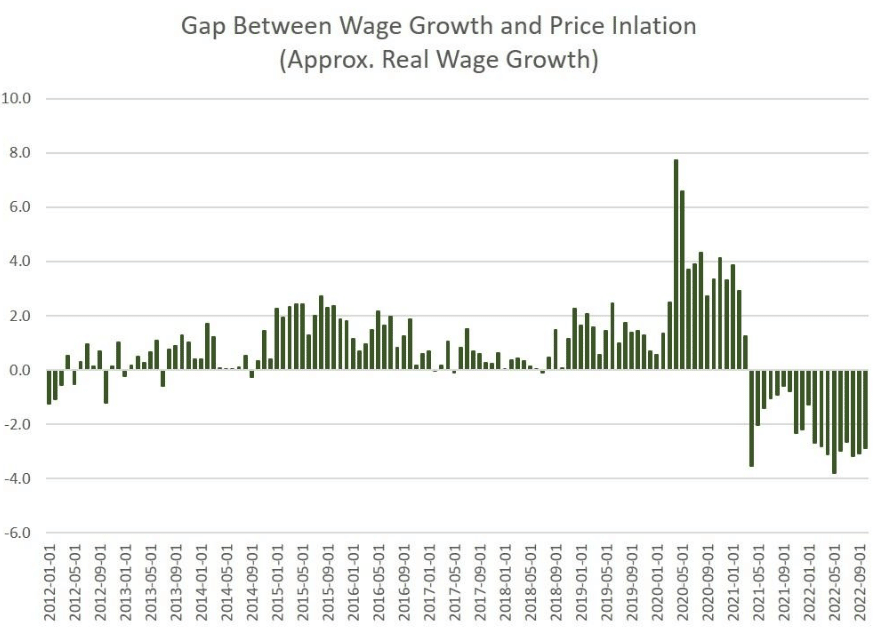

According to a new report from the Bureau of Labor Statistics, prices rose 0.4% from September 2022 to October 2022. During that time, the real average hourly earnings for all employees fell by 0.1% as inflation outpaced wage growth, according to a separate report from the Bureau of Labor Statistics.

Real wages fell even further over the last year as prices rose 7.7% between October 2021 and October 2022.

“Real average hourly earnings decreased 2.8 percent, seasonally adjusted, from October 2021 to October 2022,” the report said. “The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.7-percent decrease in real average weekly earnings over this period.”

Despite prices increasing last month and Americans’ real wages decreasing, Biden responded to the report by claiming it was evidence that his “economic plan is showing results.”

“Today’s report shows that we are making progress on bringing inflation down, without giving up all of the progress we have made on economic growth and job creation,” Biden said. “My economic plan is showing results, and the American people can see that we are facing global economic challenges from a position of strength.”

More from NewsWars:

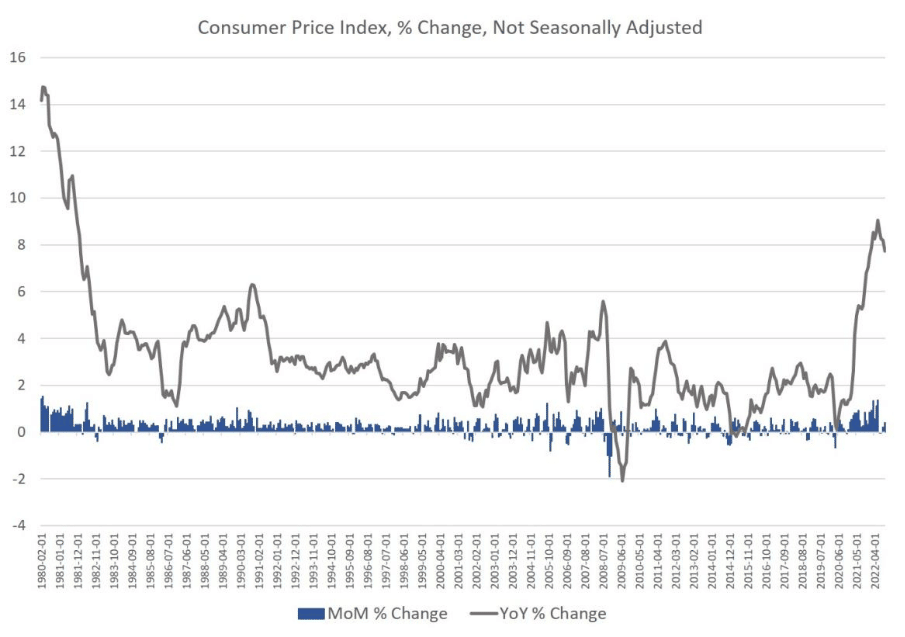

The federal government’s Bureau of Labor Statistics released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, but remained near 40-year highs.

According to the BLS, Consumer Price Index (CPI) inflation rose 7.7 percent year over year during October, before seasonal adjustment. That’s the twentieth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s eleven months in a row of price inflation above 7 percent.

Month-over-month inflation rose as well, with the CPI rising 0.4 percent from September to October. October’s month-over-month growth also shows some acceleration in monthly price inflation growth. Month-to-month growth had been approximately zero in July and August.

October’s growth rate is down from June’s high of 9.1 percent, which was the highest price inflation rate since 1981. But October’s growth rate still keeps price inflation well above growth rates seen in any month during the 1990s, 2000s, or 2010s. October’s increase was the eighth-largest increase in forty years.

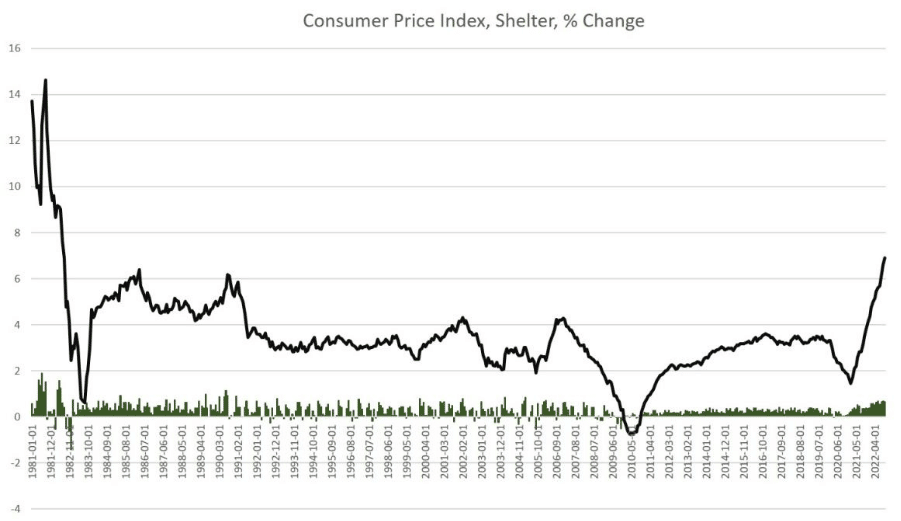

The ongoing price increases largely reflect price growth in food, energy, transportation, and especially shelter. In other words, the prices of essentials all saw big increases in October over the previous year.

For example, “food at home”—i.e., grocery bills—was up 12.4 percent in October over the previous year. Gasoline continued to be up, rising 17.5 percent year over year, while new vehicles were up 8.4 percent. Shelter registered one of the more mild increases, with a rise of 6.9 percent, according to the BLS.

The rise in shelter, however, was an increase in October over September when shelter prices rose “only” 6.6 percent, year over year. In October this year, shelter prices were up 6.9 percent year over year, and 0.7 percent, month over month. This was the largest month-over-month increase since March of 2006 and was the largest year-over-year increase since July of 1982. The CPI is finally starting to reflect the enormous surges in costs that many renters have been experiencing in recent years.

In other words, now is a time of mounting danger that the central bank will return to the same failed policies of the last 25 years in which it turns to ever larger monetary stimulus in order to prevent recession-fueled deflation. The markets are even now banking that the Fed will take a more dovish turn now that CPI inflation has slightly fallen. For example, mortgage rates fell sharply on Thursday in the wake of the new inflation numbers’ release.

Yet, Americans continue to get poorer as price inflation continues to outpace growth in wages. In October, average hourly earnings grew by 4.86 percent. Given that price inflation surged by 7.7 percent, that real wage growth of about -2.9 percent. That’s the nineteenth month in a row during which real wages fell.

Meanwhile, the jobs data shows few signs of improving. In October, the number of employed persons in the US fell by 328,000, and remains below the February 2020 peak. Moreover, according to the Bureau of Economic Analysis, disposable income is lower now than it was before the covid panic, coming in at $15,130. That sum was $15,232 during February of 2020. Meanwhile, the personal savings rate in September fell to 3.1 percent. That’s the second-lowest level since 2007. Credit card debt, in contrast, reached new highs in September and is now well above its previous 2020 peak. More recent news is hardly better. Meta (Facebook) announced it is laying off 11,000 workers this week, adding to continuing job woes for the tech sector. Home construction and home sales activity is set to show big declines, which will lead to layoffs in real-estate related industries.

Price inflation is indeed likely slowing, but it is slowing as a result of a struggling economy. The White House may soon find it is celebrating much too soon.