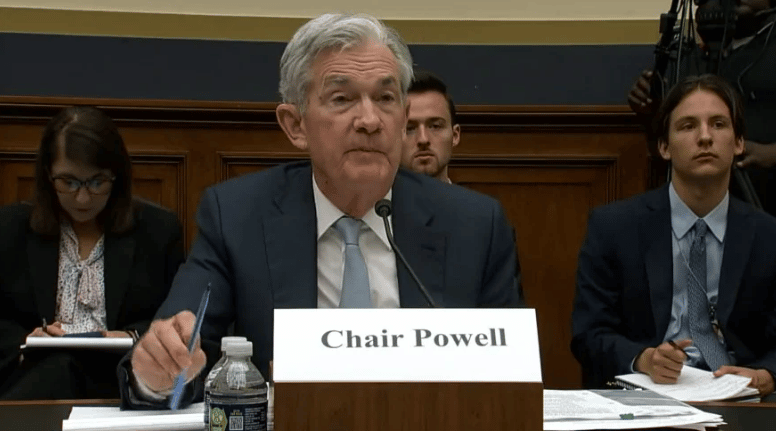

Biden’s Federal Reserve Chief Jerome Powell and the FED increased the FED Funds rate again today.

On Wednesday, the Federal Reserve again turned to its only weapon to try to contain the 40-year high inflation, by increasing interest rates for the sixth time in 2022.

The Daily Caller reports:

The Federal Reserve announced an interest rate hike of 0.75 percentage points, bumping the range of the federal interest rate to between 3.75% and 4% following a Wednesday meeting of Fed policymakers.

The rate hike matches investor expectations and is the fifth consecutive hike since March and the fourth at this aggressive pace since June as the Federal Reserve attempts to cool the economy and blunt persistently high inflation, The Wall Street Journal reported Tuesday. All eyes are now on the Fed’s December meeting, with investors debating whether the Fed will continue at its aggressive pace of 0.75 percentage point hikes or slow to 0.5 in a bid to ease the pressure on an economy an emerging consensus of analysts say is heading towards a recession.

Some investors were hoping the Fed would begin a “pivot” towards reduced rate hikes in December after various signs that the economy was beginning to slow, Reuters reported Tuesday. However, following a Bureau of Labor Statistics report Tuesday that showed an unexpectedly strong labor market, with job openings in September nearly recouping an August decline, some investors believe the Fed will likely see itself as having more work to do in prompting a slowdown.

In reaction to the news, the markets are down. The FED voted unanimously to increase the rates today:

By a unanimous vote, the Fed hiked its rate by 0.75 percentage points to a range of 3.75% to 4%. That’s the highest level in 15 years.

In new language, the Fed said it expects to continue with further rate hikes “until they are sufficiently restrictive” to return inflation to 2% “over time.”