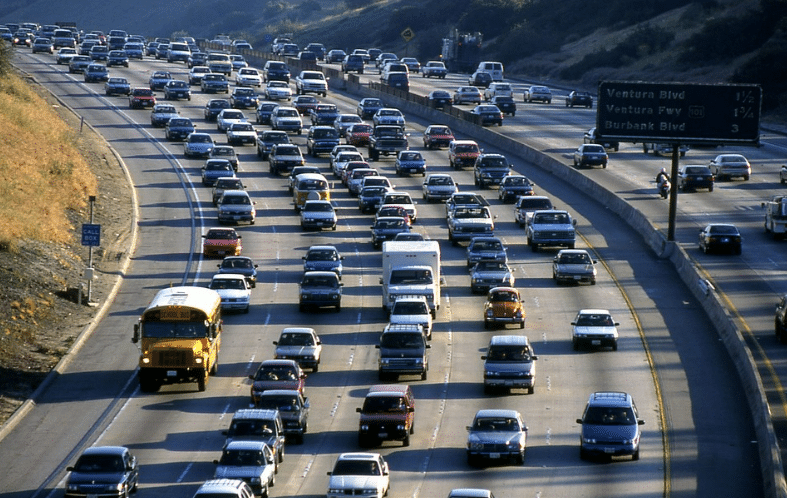

New data reveals the challenges American consumers face in keeping up with their financial obligations, particularly concerning their auto payments.

In September, the rate of subprime interest rate borrowers falling 60 days or more behind on their payments reached 6.11 percent, as reported by Bloomberg. This marks the highest share who can’t make ends meet since 1994, and up from the 5.93 percent rate at the start of this year.

Margaret Rowe, Senior Director at Fitch, noted, “The subprime borrower is getting squeezed. They can often be a first line of where we start to see the negative effects of macroeconomic headwinds.”

“Consumers starting to buckle for first time in a decade, former Walmart U.S. CEO Bill Simon warns”

— DC (@bioadultmale) October 12, 2023

Record credit card debt & car loan amounts and duration- inflation…. Bidenomics at workhttps://t.co/4omFZTdKYD

As interest rates rise, making new loans more costly, a significant number of car owners find themselves grappling with the affordability of their payments. This underscores a notable sense of financial strain during a period when the economy is sending mixed signals, particularly regarding the state of consumer spending.

WHAT DID WE LEARN TODAY?

— Arms Johnston (@JohnstonAr41492) September 15, 2023

Bidenomics is working so well that we have the HIGHEST CREDIT CARD DEBT ever and Car loan delinquancy rate is skyrocketing!

According to a CNN report, the trajectory suggests that the issue is going to get worse. The report highlighted that Moody’s current projection indicates that the rate of delinquent vehicle loans is expected to reach 10 percent by 2024.

CNN also pointed out that consumer delinquencies extend beyond car loans.

In the second quarter, the rate of new credit card delinquencies rose to 7.2 percent, marking an increase from the previous quarter’s 6.5 percent.

Bloomberg also reported that during the same period, credit card debt surpassed the $1 trillion mark.

Good point.

— Keith Patterson (@KPattersonNJ) October 16, 2023

1.03 trillion in credit card debt which is the most since 1999 when they started keeping track.

Also, the percentage of car loan defaults and small business bankruptcies have also been rising.

Bidenomics at work.