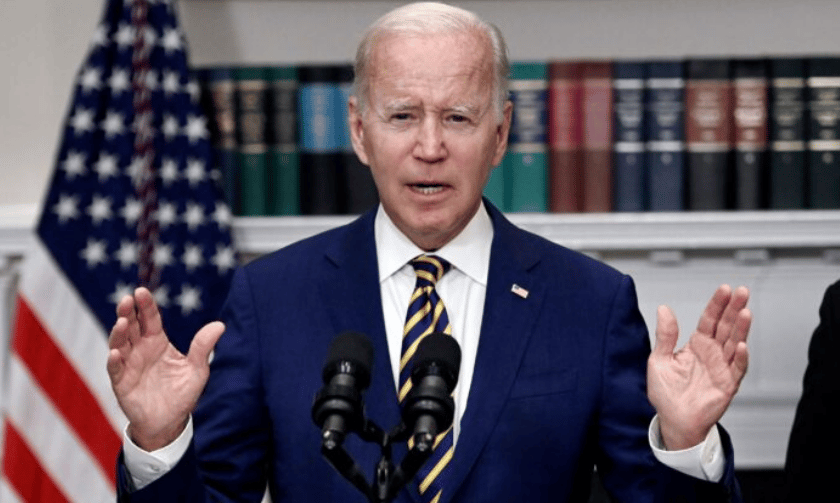

The Biden admin quietly scaled back eligibility for its student loan forgiveness plan Thursday, the same day six Republican-led states sued Biden and his education secretary in an effort to block his student loan forgiveness plan from taking effect.

As of Thursday, borrowers who have federal student loans that are owned by private entities and not by the U.S. Department of Education will no longer qualify for the relief program.

CBS News reported:

Borrowers whose federal student loans are guaranteed by the government but held by private lenders will now be excluded from receiving debt relief. Around 770,000 people will be affected by the change, according to an administration official.

The Department of Education initially said these loans, many of which were made under the former Federal Family Education Loan program and FEderal Perkins Loan program, would be eligible for the one-time forgiveness action as long as the borrower consolidated his or her debt into the federal Direct loan program.

On Thursday, the department reversed course. According to its website, privately held federal student loans must have been consolidated before September 29 in order to be eligible for the debt relief.